A while back, while cleaning up some of the stuff I left at my mom’s house years ago, I found an old spreadsheet I created with all of my bills on it.

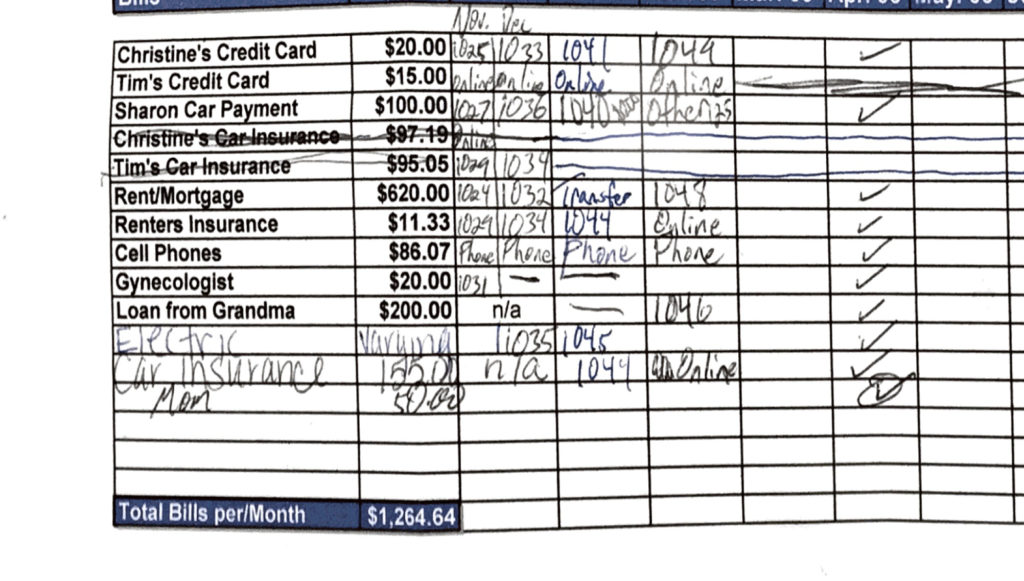

The spreadsheet was created around the second year my wife and I were married. We’re going on year fourteen now, so this was about twelve years ago. Quite a long time! Here’s what the spreadsheet looked like:

It served as a big reminder of how easy lifestyle inflation can creep up on an unsuspecting budget.

Back about twelve years ago I had a couple of minor credit card payments, a car payment, rent, various insurance policies, cell phones, medical bill, a loan from my wife’s grandma, and some sort of $50 payment to my mom. Adding up all of that it totals $1,277.40 in total bills.

Ah, those were the days.

It’s crazy how things change. If you notice, I have four-digit numbers all over the spreadsheet.

Thos are check numbers. Seems I’m dating myself a bit. 😉

This was even before I started budgeting for things like gasoline and groceries every month. With it being only my wife and me, we didn’t spend a ton on groceries. We used to spend about $100 to $150 a month on groceries, if that, and maybe $200 on fuel.

Electric wasn’t much to write home about but I estimate it was about $100 during peak months. We had electric heating during this time period so natural gas wasn’t needed.

In total, we’re looking at monthly expenses for our needs at about $1,727.40 by my estimation.

The Past vs. The Present

Finding this old bills spreadsheet was an awakening to exactly how much our lifestyle has inflated over the past twelve years. I’ve always known we spend more now on a monthly basis than we did back then, but this is giving me the nitty-gritty details.

So what do our bills look like now?

Our total bills as of right now, including credit card payments, mortgage, and everything else we budget for, equal…(drumroll, please)…

$5,788.61

That’s more than $4,000 more every month than it was twelve years ago! So what’s changed? Here is a short-ish list:

- Our mortgage (insurance, taxes, and payment) is about $1,100 more per month than our rent was. Our mortgage monthly payment is more now than the entirety of our expenses now.

- Since we bought a house, we have all of the “fun” that comes with it—higher electric bill, natural gas heating, water bill, homeowners insurance, budget for household items and home repairs, etc.

- We now budget for car repairs, eating out, date nights, personal care items, etc.

- Our credit card bills are much higher (until we pay them off!)

- Compared to 12 years ago, we have internet, Netflix, Hulu Plus

- This was before smartphones so our phone bill is more than twice the amount

A lot changes in twelve years! Of course, we make quite a bit more than we did back then—which is nice—but imagine having a salary 3 times the amount of what you had twelve years ago with only a minimal increase in budget.

I’d be retired by now!

I exaggerate, but you get the point.

Reversing Lifestyle Inflation

Reversing Lifestyle Inflation

Lately, I’ve been trying to really be intentional with our money. I think it’s more than fine to inflate your lifestyle if it allows you to do what you value and stick to your budget.

If you value early retirement, then you probably would have done a lot more to keep your bills in check as your income grew, rather than let lifestyle inflation set in like I did.

If you value being able to spend money on vacations and eating out, then you might inflate your lifestyle even more than I did.

Nothing wrong with that as long as it’s intentional.

The problem with my situation is that it wasn’t intentional. So now I get to circle back and reverse course.

Here are some things that I’m going to be doing, and some tips for you, on how to reverse lifestyle inflation.

Sell Your Unwanted Stuff

As our income rises over the years, we tend to buy more “stuff,” especially if we are unhappy. I’ve written before about how video games were my go-to purchase when I was unhappy but also making a little bit of money.

In short, I had a bunch of video games that I had never played, or played very rarely and were barely started. I went through all of the games that I wasn’t sure I wanted, popped them each in and played them for about 5 or 10 minutes. If I wasn’t convinced that I was ever going to play through them, I put them off to the side to be sold.

I took them to Best Buy and traded in every one they would take. I got about 25 cents each, totaling $3.25.

In hindsight, I probably could have gotten at least a dollar for each game on Facebook. However, even though I got next to nothing for these games, it felt good selling something that I didn’t need anymore. It decluttered my shelf and my life.

Take a look around your home. You may have some stuff that you’ve bought and don’t need that may be valuable to someone else.

Did you buy a bunch of expensive furniture for a room you never sit in? You could sell the mostly unused furniture and downsize to some cheaper (but still nice looking) chairs from Target or Ross or somewhere similar.

This works well for pretty much anything you don’t need around the house. For larger, more expensive items, you can sell on eBay or Craigslist. For smaller items and knick-knacks, you can make a decent buck with a garage sale.

This declutters your life and gets rid of the unnecessary things you bought while inflating your lifestyle. It can also give you some cash for decluttering your debt!

Keep Track of Your Expenses

As I mentioned, my lifestyle inflation was not intentional by any means. I didn’t have a goal I was trying to fulfill in raising the amount of spending I was doing each month.

On my old budget, I wasn’t budgeting for eating out or any type of extra activities. I have literally no idea how much we were spending on that stuff.

I just kept adding to my budget without considering the overall picture of what I wanted my future to look like. If we could afford it—as in, not spend more than we make—I was able to put it on the budget.

I didn’t start tracking our extra stuff until about five years ago. This was when I got really serious about paying off debt. I wasn’t tracking my expenses beyond putting it down on an electronic sheet of paper.

In order to reverse lifestyle inflation, tracking your expenses is one of the most important things you can do. It’s impossible to know where your money is going if you’re not tracking it.

Track your expenses against your overall goals. Whenever you consider adding a new expense, ask yourself if it lines up with your values or with your future goals.

If it does, then great! If not, then leave it off your spending plan.

Note: I use You Need a Budget (YNAB) to do all of my budgeting.

It is an awesome tool where you set yourself a budget every month—or just copy the one from the previous month—and then categorize your transactions throughout the month according to those budget categories.

They provide a free app as well so you always have your budget with you and are able to enter transactions on the go.

If you sign up using my link, you’ll get the normal 34-day trial and then an additional free month after you subscribe.

Save Automatically

A great way to reverse lifestyle inflation is to artificially reduce the amount of money you bring home. One of the best ways to do this is to set up your savings to be automatic.

If you have a 401K account at work, you can elect to have a higher percentage taken out of your paycheck. This not only provides you with tax savings now but also reduces your take home pay, forcing you to live off of less.

Another good option is to have your employer deposit some of your pay into a separate savings account. Some employers have the ability to deposit your check into multiple accounts through direct deposit.

Lastly, if neither of the above two are options for you, you can set up automatic transfers through your bank.

Transfer a certain dollar amount or certain percentage on the day you get paid. Then, subtract that amount from your net pay that you have listed with your bills.

The point of setting this up to be done automatically is for you to live off less than you do now. The money is still yours, essentially, but you really don’t see it in your checking account.

Impulse Saving

This is a play on the term “impulse buying,” that temptation and eventual giving in to purchase those really-easy-to-grab things near the counter at a store.

Often times, we go to the store for a particular item and come out with two additional items. This happens a lot with groceries but window shopping also makes you susceptible to impulse buying.

It’s not realistic to expect anyone to never go to the store so I came up with this method of saving.

Impulse saving!

Here’s how it works.

First, download your bank’s mobile app (pretty sure almost all banks have one these days). Now, the next time you go to the store and have the urge to buy something extra, take a look at the price tag. Let’s use a $20 movie as an example.

When you have the urge to buy that $20 movie, pull out your phone, open up your banking app, and immediately transfer $20 to your savings account.

This keeps you from buying impulsively and also gives your savings a boost. Two birds with one stone!

Impulse saving helps reverse lifestyle inflation because you no longer have that money to spend. You’ve put it away in a savings account. It’s a similar concept to automating your savings. If you don’t have the money to spend, you won’t be able to spend it.

Delay Gratification

Have you ever seen a child in a store react to something they want in the store? They walk by a toy and now they can’t live without it.

I know this all too well with my girls. What happens when you tell them no? They cry and complain, something you deal with, and then they get home and forget all about the item they wanted.

This is something that’s easier said than done since adults have better memories than children. If you have the urge to buy something, try and wait for 30 days before you purchase it. This not only allows time for the urge to pass, but it also allows you time to think about if you really need it.

I’ve had to do this several times for the same thing before. I feel like every time Apple releases a new iPad I want one.

Do I need one? Definitely not.

So I wait, remember that my iPad is good enough for what I use it for, and then I calm down after a while and don’t desire it.

When the desire comes back up, rinse and repeat. Most desires go away over time unless they are legitimate needs so this is a great way to keep unintentional purchases at bay.

Delaying gratification is great for reversing lifestyle inflation because you are no longer acquiring excess stuff, especially expensive stuff. Try this the next time you have an urge to buy something.

Pay Off Your Debt

Another great way to reverse lifestyle inflation is to prioritize paying off your debt. When I paid off $26,000 in 11 months, I was hyper-focused on my debt and it was relatively easy to stick with my budget.

First, figure out the amount you can safely put toward debt. So if you have $500 left over each month after all expenses in your budget, you may feel comfortable using $400 toward debt. I like to leave a little wiggle room. You may feel comfortable putting the entire $500 toward debt.

Next, put that amount down as a separate bill within your budget. I’ve got mine in You Need a Budget as a separate line item. What this does is you are essentially treating it like another bill. It will have to be paid and shouldn’t be missed.

Now, determine what debt you want to pay off first. Will you be paying off the highest interest rate first? Maybe you’d like to do the Debt Snowball and go for the lowest balance first. Make note of whatever debt you decide to pay down first.

Lastly, to make it easier on yourself, feel free to set up automatic payments on whatever piece of debt you are paying off first. This has the same effect as automating your savings. If it’s automatic you essentially don’t “have” the money anymore.

Use your debt as a way to reverse your lifestyle inflation.

More Extreme Methods

All of the above methods I’ve used before or am currently using now. The below methods are not for everyone, but I wanted to list them for you. It is your decision whether to try these methods or not, but they are there for you to try.

Downsize Your Home

Do you use all of the rooms in your home or is half the house closed off so you don’t have to climate control the part that isn’t being used? Did you purchase a 4500 square foot home just because you could afford it?

Ask yourself if you really need all of the space or if your mortgage is getting in the way of other financial goals.

It might be time to downsize your house.

Now, this will cost you a little bit of money up front with closing costs and such. However, if you are moving from a $400,000 home to a $200,000, closing costs will pay for itself in no time with a much smaller mortgage.

Depending on how far along in your mortgage you are, downsizing may even allow you to be mortgage free!

Another option if you do buy smaller is to go with a 15-year mortgage. Depending on how far you go in downsizing, a 15-year mortgage may still be quite a bit cheaper than a 30-year mortgage on a more expensive house. Talk it over with your bank and realtor.

At the same time, you could get a 30-year mortgage and pay it down like it’s a 15-year mortgage.

Downsize Your Car (or Get Rid of it Entirely)

If you are currently rockin’ a brand new car or some other expensive vehicle, another option you have is to downsize your car. This could be an option for any vehicle. If you only drive 10 minutes from your house on a regular basis, it might be worth it to trade in even a used vehicle valued at $12,000 for a beater that runs for $2,000.

This could also work if you are currently a two car family and hardly use the second car, it may be easy to sell one and keep the other. If you live in a big urban environment that has a lot of public transportation options (like Chicago), it may be worth giving up driving a vehicle entirely.

Now, this is not to say that you can’t afford the vehicle you’re currently driving. The point is to ask yourself, “Is this getting in the way of my other financial goals or could this money be used elsewhere?”

That answer will completely depend on you.

Move to a Different City

Think for a moment about what city you live in or near. Moving from one city to another can drastically change your lifestyle.

For examples, Sperling’s Best Places compared the cost of living in Denver, Colorado to San Fransisco, California. They found that a salary of $375,000 in Denver would need to be at $801,765 to have a similar lifestyle.

That means if you were to move from Denver to San Francisco and wanted the same type of life, you would automatically have a lifestyle inflation more than double the amount.

There are other expensive cities to live in or near as well. Chicago has very high prices on things like housing, even when just comparing it to the suburbs that are an hour away.

One thing you can do to reverse lifestyle inflation is to move to a different city. If you currently live in San Fransisco, you can have the same lifestyle by moving to Denver with less than half the cost. Moving from Chicago to Memphis will reduce your costs by about 33% according to Sperling’s Best Places.

Again, this is an extreme option—and there certainly is a lot more to consider besides money—but it may be an option for some of you.

Your Turn

Our lifestyle has definitely inflated quite a bit over the years. The crazy thing is, I don’t even know where it came from. I can take educated guesses by what I have in my possession now compared to what I had back then, but that’s all it is—guesses.

I’ve heard it said that lifestyle inflation is the silent killer of your budget. That’s a fitting name considering how it can creep up on you.

I’m currently taking a look at my bills and comparing them to what they used to be. I encourage you to do the same and see if there is any lifestyle inflation that you can reverse using the above methods.

Let’s beat this thing!