Note: None of this should be taken as legal advice. In addition, life changes, such as raises, promotions, marriage, or kids, may result in a higher or lower taxable income. It’s best to consult a professional to see what is best for your individual situation. See my disclaimer for more information.

Are things a little tight in your budget right now? Or at least do you feel like things are a little tight?

What would you do for a little breathing room in your budget?

How would you like a little (or a lot) more money each month to put toward whatever you needed?

What about having more money for saving, spending, debt, eventual retirement, groceries, or literally anything you need to put it toward?

Imagine for a moment that a friend took $3,000 from you, a little bit at a time, throughout the entire year.

Then at the beginning of the following year, they gave you the $3,000 back with a “Oh here, I borrowed this from you.”

Now, because you didn’t know about your friend taking the money, it feels like you just gained $3,000.

But it was your $3,000 in the first place.

That is essentially what a tax refund is.

Right now, the average tax refund is still hovering right around $3,000, and that’s a lot of money to get back from the government.

But again, that was your money in the first place.

If we break down what $3,000 looks like over a twelve month period, we’d get an extra $250 a month to add to our current income.

For some people, that’s breathing room. For others, that is no longer worrying about putting food on the table.

With an extra $250, some people will feel like they can finally take a vacation or get out of debt.

Do you want more money in your paycheck without even worrying about asking your boss for a raise?

I Get It

Maybe you’re thinking that you would love extra money in your paycheck to use every month. But you also like getting that large refund each year because it feels like you’re getting money to use.

I totally get that.

I’ve had the same exact feelings, but I couldn’t get over being able to get more money in my paycheck to do whatever I wanted to do with it.

In my experience, there are two main reasons why people really enjoy getting a tax refund.

1. You think of it as a way to force them to save.

Studies have shown that America is not good at saving. No matter your personal finance “skill level,” it’s always hard to save.

Sometimes getting that tax refund all at once between January and April 15th forces you to save.

And it doesn’t matter that you could get more interest by saving it right after you get it on your paycheck because it never actually gets in your savings account that way.

2. You think of it as a way to put that money toward something they want to do or have.

This could be something like taking a vacation, purchasing something big, or something like debt payoff.

This covers anything you would do with the money—besides saving—when they get a semi-large windfall like a tax refund.

Sometimes we feel like we don’t have the money to do what we want with our lives. By having that tax refund come in every year, we feel like we now have extra money to do with as we please.

Both of these reasons have been driving factors in me wanting a big return in the past as well.

What if I Told You that You Could Get the Best of Both Worlds?

What if you could have the extra money in your paycheck and still be able to do exactly what you want with your money as if you were getting the tax refund still?

If you could satisfy whatever reason you have for getting a tax refund without giving the government an interest-free loan and control over your money, would you do it?

Well, I’ve got some great news for you.

You can have the best of both worlds.

And I’m going to show you how.

The Magic of Automatic Transfers

One of the beauties of getting a tax refund is that, since it isn’t in your hands all year, you don’t have a chance to spend on things that you didn’t mean to spend it on.

That’s where automatic transfers come in.

When you set up automatic transfers after getting your money back in your paycheck, it’ll feel exactly the same as if you never had the money in the first place. You won’t even see that in your bank account—unless that’s where you want it.

Instead, you’ll see some breathing room in your budget, your savings account increase, your investments increase, your debt decrease, your vacation fund increase, or whatever goal you’ve set for yourself.

And it’s easy!

Once this is set up you won’t have to do anything but watch your financial goals get closer.

In order to make this work, you’ll need to do a few things to ensure you’re getting the money you’re supposed to get throughout the year as well as making sure you don’t owe the IRS any money.

And I’ll be here to guide you the whole way.

I’m going to take you through:

- How to change your tax withholdings so you get your tax return money throughout the year on your paycheck instead of in a lump sum during tax season

- Some ideas of what to do with your new money so you’re able to put it toward your goals or toward giving you some financial breathing room—without the danger of losing that money.

Let’s get started!

Step 1: Figure Out Your Current Tax Withholdings

Start by finding your payroll information on your most recent check stub. Some things that you’ll want to look for are:

- Federal Withholding dollar amount

- Social Security dollar amount

- Medicare dollar amount (sometimes combined with Social Security as FICA)

- State Tax dollar amount (Unless you’re one of the seven States that doesn’t collect income tax)

- Any type of post or pretax deduction dollar amounts such as healthcare premiums, 401K contributions, etc.

You’ll also need to know how many dependents you claimed on your W-4 form when you were first hired.

For a lot of people, this will be zero. If you don’t remember, you can always ask your payroll department or manager what they have on file.

Step 2: Head to Paycheckcity

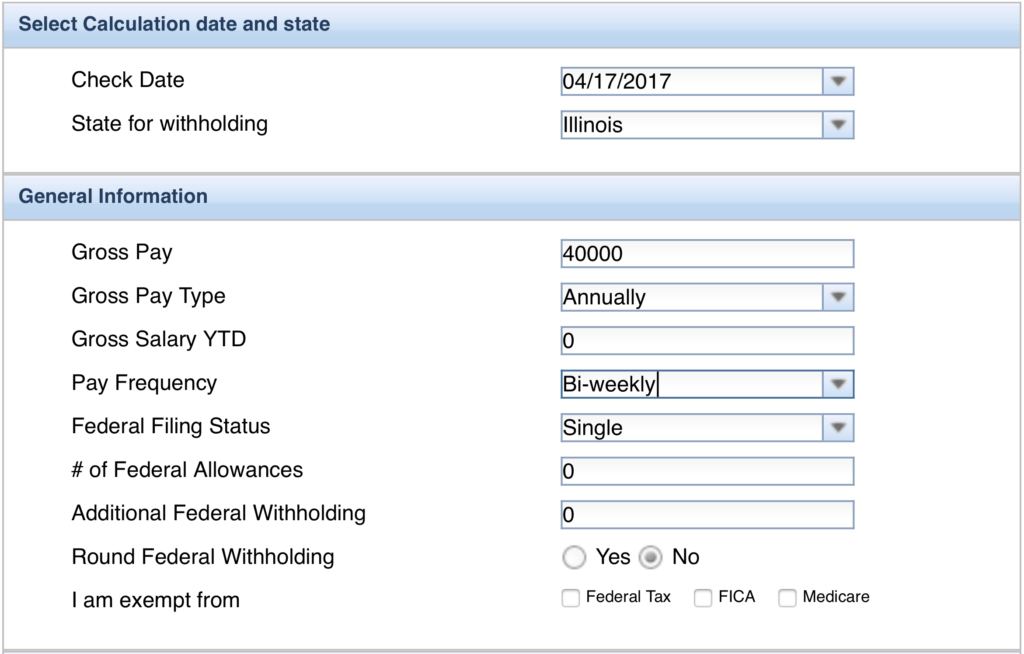

Navigate to paycheckcity.com and enter your current payroll information. Your payroll information will be on your most recent check stub.

On the homepage, you’ll be presented with a row of options that look like this.

Select the salary calculator if you are salaried or hourly calculator if you get paid by the hour (I know…captain obvious over here).

The only difference between the two is that the hourly calculator adds an extra section called “Rates Information.”

You put in your hourly rate in this section and it calculates your gross pay in the “General Information” section rather than manually entering your gross pay like in the salary calculator.

By selecting one of the two paycheck calculators you’ll be presented with a screen that looks more or less like this.

The date isn’t going to matter for our purposes so go ahead and start by selecting the state you live in. After you select your state, continue by adding your salary or hourly information.

Salaried Employees

For salary, enter in your gross pay, make sure gross pay type is set to annually, and select your pay frequency.

Hourly Employees

For hourly, you’ll have that extra “Rates Information” section to be able to enter your hourly rate. This will auto-populate the Gross Pay field—rather than needing to manually add your gross pay—and defaults to the gross pay per pay period.

This is fine unless you want to see how much you make a year.

You’ll want to enter the number of hours you usually work in your standard pay period. So if you get paid every two weeks and always work 80 hours in that two week period, you’ll want to put “80” in the “Hours #1 field.”

On to Your Tax Information!

After entering your pay information, select:

- your filing status

- the number of federal allowances you currently claim

- additional withholdings or exemptions (if these apply)

This is what it looks like.

As an example, my filing status is Married and I currently claim 3 allowances on my federal taxes. I have no additional withholdings and am not exempt from any taxes.

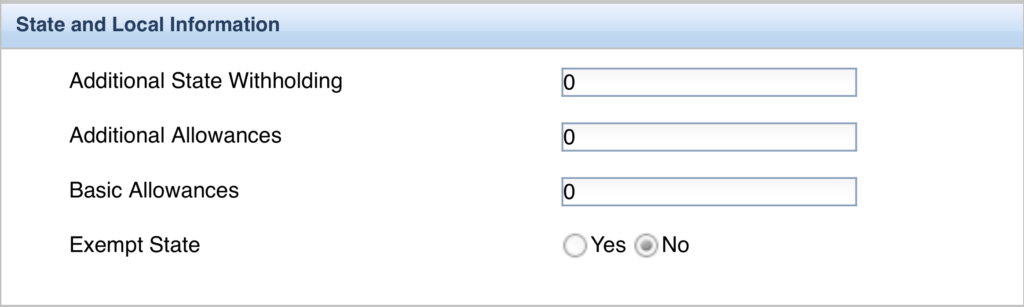

Next, enter your state information. Depending on your state, this section will look a little different. Illinois looks like this.

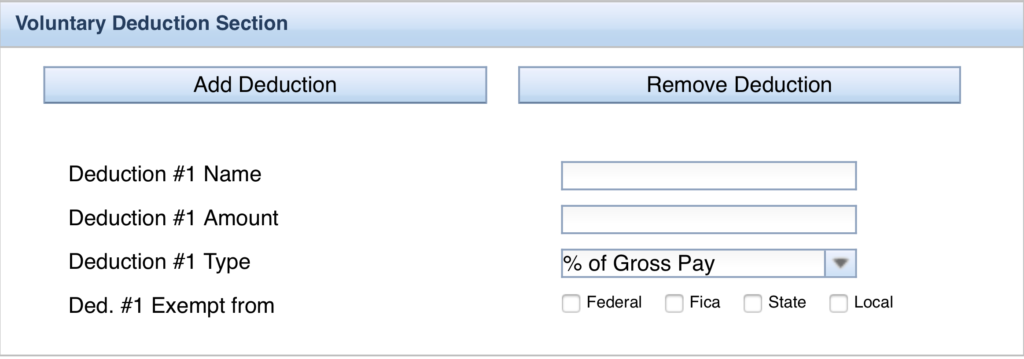

Deductions Section

After you enter your state info you’ll come to the “Voluntary Deductions” section. This is where you enter in your medical premiums and deductions, 401K or Roth IRA deductions, things like public transportation monthly passes, or anything else that is taken out of your check.

There are buttons to add or remove deductions if you need to do so. Don’t forget to change the drop down from percentage to fixed amount for deductions that are set dollar amounts like medical premiums.

Depending on the deduction, you may be exempt from none or all of these. Here are some examples:

- Roth retirement accounts – These are not exempt from any taxes

- Traditional 401Ks – exempt from Federal taxes, taxes in some states, but not FICA

- Healthcare premiums – exempt from everything

I highly recommend comparing what Paycheckcity gives you to what your actual pay stub looks like after putting in your deductions. They will be almost an exact match and it’s a great way to make sure you’ve checked all the right boxes.

Also, if you have any of the exempt deductions taken out post-tax (as in, they are being taxed), it might be worth checking to see if your employer can start taking them out as pre-tax deductions.

Calculate Button

After you are done with your deductions—or determine you don’t have any right now—select the “Calculate” button at the bottom.

When the paycheck information loads, it should match your current paycheck (it may be off by a few pennies in some tax categories).

If it isn’t, go back to the calculator, double check everything, and fix what might be wrong.

Step 3: Start Adjusting

This step is where the fun begins and you start to see how much more money you can get on your check!

This step is where the fun begins and you start to see how much more money you can get on your check!

Note: When you hit the back button to go back and adjust your amounts, the deduction information may not stick. The drop-down changes—such as changing from percent of gross to a fixed dollar amount—should remain. However, you might need to re-enter in your deduction name and amount.

For this part, you’ll need to know how much your tax refund was this year for both state and federal. Let’s start with federal.

Figuring Out What to Change for Federal

What you want to do here is divide your federal tax refund amount by the number of paychecks you receive in a year. Here are some examples:

- If you get paid weekly, divide your tax refund by 52

- Divide by 26 if you get paid every other week (26 times a year)

- Divide by 24 if you get paid twice a month (24 times a year)

Now that you’ve got that number, the goal is to gain as close to this amount as you can on each paycheck without going over. Going over means you would owe the government something. We don’t want that either.

As an example, if you received a $1200 tax refund and get paid 24 times a year, you’re going to want to adjust your holdings so you get as close as you can to $50 added back to each paycheck without exceeding that amount.

Start Small

For this part, we’re going to be concentrating on the “General Information” section, specifically the field titled “# of Federal Allowances.” Unless your refund was $2,000 or $3,000, it’s best to start small with the changes in your deductions.

Hit the back button and add 1 to your federal allowances. So if you are claiming 0 in that field, you’ll change it to 1. If you’re claiming 1, change it to 2, etc.

Double check to make sure your deductions are correct again and then hit the “Calculate” button.

Is the additional amount on your paycheck close to the amount we got when dividing your refund by the number of times you get paid without going over?

If it is, then you’re done! Woohoo!

If not, try increasing your federal allowances again.

Hit the back button again and add to the number of federal allowances and hit the “calculate” button again.

Repeat this until you are close to your amount but not over it.

For example, if you try a federal allowance of 3 and it is over the dollar amount you are shooting for, then you know that you can claim a federal allowance of 2 and not any more than that.

Write this new federal allowance down somewhere so you remember it.

Also, write down how much you are gaining on your check. This is the amount that you will be automatically transferring to saving.

Adjusting State Withholdings

Repeat the same process for state withholdings.

- Divide your state refund by the number of times you get paid

- Start small and make changes to the “State and Local Information” section

- Figure out how many allowances you can claim to get as close to the monthly version of your state refund number

- Write down the new number of allowances you’ll claim

- Write down the amount your check has increased by so you set up an automatic transfer to your savings account

If you live in Alaska, Florida, Nevada, South Dakota, Texas, Washington, or Wyoming, you won’t even have to worry about this section. Due to those seven states not having state income tax, this section will be completely blank.

For Illinois, I focus on the basic allowances. I claim 2 for those. Your state may vary on what field you should be looking at.

As soon as you figure out what you can claim for allowances on your state income tax, write this number down with your federal allowance.

Again, write down the dollar amount of the change to your state tax on your check. We’ll add this to the amount we’re already going to be transferring automatically to savings from federal.

Step 4: Take Action

Step 4: Take Action

Now, that we have all that out of the way, you can make these changes with your employer.

Take the number of Federal and State allowances you’ve written down and find out from your employer how to change them for tax purposes.

You will more than likely have to fill out a new W-4 for your federal insurance. Some companies let you make changes electronically to federal.

My company allows me to change federal electronically, but for state, I have to fill out a new form. Your mileage may vary.

After filling out the new forms, determine when this will take effect. Depending on your companies payroll system, it could take effect the very next paycheck or take two or three pay periods to update.

Knowing when your paycheck will change will help you know when to start the automatic transfers.

Step 5: Set Up Automatic Transfers

Now it’s time to protect that new money on your paycheck by setting up automatic transfers!

Setting up an auto transfer for this new money on your paycheck will have the twofold effect of still feeling like you are not seeing the money as well as allowing you to earn some interest on your money.

There are two main ways to do this. You can:

- Set up a direct deposit through your employer into a separate bank account for only the amount you’ve added to your check

- Set up a recurring automatic transfer from your checking account to your savings account for the day after you get paid

An additional direct deposit is the most ideal method because you will never even see that money in your checking account.

If your employer doesn’t offer it, the recurring bank transfer will do nicely as well. Ask your bank how to set this up if you need more information.

Step 6: Decide What to do With Your Money

That’s it! You’ve officially given yourself a raise without even needing to talk to your boss about it.

More money on your paycheck will mean different things for different people. Here are some ideas for what to do with your money.

- Save it. Having more money on your paycheck—especially money you weren’t expecting—means it’s easier to save that money. Set up the automatic transfer to a high-interest savings account like Ally Bank has and watch your money grow.

- Give yourself some breathing room. If you’re struggling to break out of the paycheck-to-paycheck cycle, the extra money can give you some much needed breathing room

- Save for a vacation. Have always wanted to visit Disney World? Maybe you’ve been wishing you could have a week-long trip on the west coast or overseas. The extra money may be your opportunity to save for it while not affecting your budget much.

- Pay off your debt a lot faster. Even if you’re only receiving an extra $200 a month, that is $2,400 more per year that you could be using to pay down your debt faster. Seriously consider this option if you’ve been wanting more freedom.

- Build up your emergency fund. That extra money could build that safety net you’ve been wanting to build but never had the money to build before. Here are some more ways you can build it fast.

- Use it toward continuing education. Put this toward either increasing your own knowledge and bolstering your career, or if you have kids, start saving for their college tuition.

- Increase one of your budget categories. Maybe you’ve been dying to go out to eat just a little bit more or give yourself some breathing room in your grocery budget. Put the money toward the category that would suit you best.

- Anything you feel is best for you. This is your show. Put this money where you feel is going to be best for you even if it’s outside of any of these ideas.

Really, the sky is the limit on this. Determine where you think the money should go, and then take action in putting it there.

The Best of Both Worlds

Many people like to get a tax refund and I completely understand why. It’s a financial adrenaline shot to the arm when you get a big check.

When you get that check, you can all of a sudden pay off a bunch of debt or go on a nice vacation. You may use it to bolster your emergency fund or investment accounts and feel like you have more discipline to use it how it’s intended if you get it all at one time.

The only problem is that this money is out of your control when it’s in the government’s hands. That money is not doing anything for you. It isn’t growing, working for you, or giving you some much needed breathing room.

Adjusting your tax withholdings and setting up automatic transfers will put the money in your control and allow you to do with it whatever is best for you.

It gives you the same feeling of not having the money since it isn’t in your checking account, but it keeps the money in your hands. And that’s where it belongs.

Give it a try! I promise you won’t regret it.

Editor’s Note: This post was originally published in April 2017 and has been completely updated for accuracy and comprehensiveness.